Own the Demand

Disclaimer: I’m a product manager at Uber. This piece represents my views only, and not those of Uber, fellow employees, managers, customers, clients, suppliers, investors or people working on behalf of Uber.

In The Internet Economy, Chris Dixon remarks that:

When evaluating an internet company’s strategic position (the defensibility of its profit moat), you need to consider: 1) how the company generates revenue and profits, 2) the loop in its entirety, not just the layers in which the company has products.

For example, consider the different entities involved when you make a Google search:

- Your browser

- Your OS

- Your computer

- Your ISP

- (A bunch of WAN stuff)

- Google’s ISP

- Google’s servers, including their own OS, networking stack, hardware, etc…

Every layer here between you and Google represents some control they give up over the end-user experience and relinquish to the owner of that layer: Firefox for the browser, Apple for the OS and computer, Comcast for the ISP, etc… That’s one big reason why Google gets into the business of building OSes (Android, Chrome OS), computers (Chromebooks), browsers (Chrome) and even took a stab at taking over your Internet access (Google Fiber, Google Fi).

It’s not just Google either. Most web giants have been making similar (though less successful) attempts at taking over their complements. Think about the Amazon Fire phone or the Facebook phone. Sometimes companies will try to outright bypass the entire stack and go directly to their customer — that’s one big strategic impetus behind the Amazon Echo. There’s no pesky computer, OS, or browser built by other people. All is controlled by Amazon.

All these giants are keenly aware that they’re building their castle on somebody else’s yard; and they’re afraid that the floor may drop out from under them. You can find one recent justification for this fear in Apple’s last release of iOS and MacOS, which significantly curtails the ability of online advertisers to track your online whereabouts. That’s Facebook’s bread and butter we’re talking about! Other famous examples are Facebook basically killing Zynga in 2012; or Twitter a bunch of 3rd party clients.

In short, if somebody successfully inserts themselves between you and your customer, they can exercise tremendous control over you, including taking a big chunk of your profits or outright killing you.

This is one key insight in Ben Thompson’s famous Aggregation Theory: modern marketplaces get their power from aggregating the demand side. And that’s a much better position than the old way of trying to own the supply side.

(A simple way to explain the idea is through Brussels sprouts. Given a choice, would you rather own the world’s supply of Brussel sprouts, or its demand? I say you should pick the latter. Owning all the supply would allow you to dictate your own prices, which is nice; but it would also require owning all the land on which Brussels sprouts can grow. That would be absurdly expensive and a nightmare to operate efficiently, on top of being quite a precarious position. How do you know you haven’t forgotten one piece of land somewhere? Or stay ahead of innovations like indoor farming? Controlling all the demand for Brussel sprouts, on the other hand, gives you the same pricing power, without the need to own and operate all that land.)

There’s this famous comment that “Uber owns no cars; Airbnb no real estate; Facebook no content; and Ebay or Alibaba no inventory.” If you can get away with being 1% as capital-intensive as your competitors while extracting greater profits, why wouldn’t you do it?

Another reason to focus on demand is that it can pull supply much more effectively than supply can pull demand. It is not the case that “the world will beat a path to your door if you build a better mouse-trap” — but if you gather everybody with a mice problem in one place, I guarantee it will soon turn into a convention for better-mouse-traps inventors.

Modern marketplaces do spend a lot of their attention on supply; but invest even more in their demand. Uber is a two-sided marketplace, yet its mission statement used to be “transportation as reliable as running water, everywhere and for everyone” (is it now “We ignite opportunity by setting the world in motion”). Airbnb’s mission is “belong anywhere.” You’ll notice both are addressed to the demand side. Uber could have gone with “turn your car into an ATM” or Airbnb “monetize your unused space.”

If given the choice to own all my inputs except demand, or own only demand and no other input, I’d pick the latter in a heartbeat. Look at e-commerce, for example.

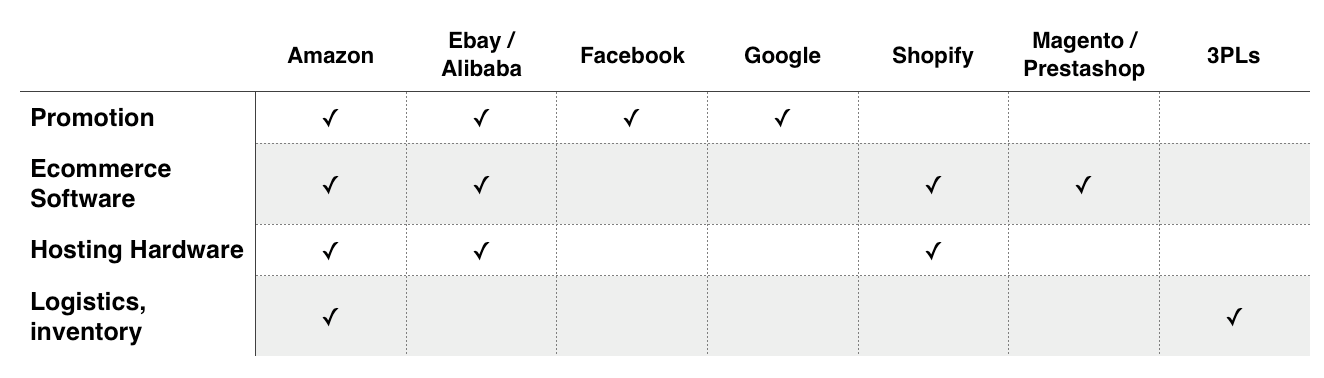

There is a clear divide between the companies owning demand, and those owning anything else.

3 final examples to illustrate my point…

Ecommerce, Facebook and Google

Retail is the largest spender in online advertising by a very wide margin. So you could argue that Facebook and Google’s “e-commerce arms” are amongst the very largest e-commerce companies in the world — all while holding no inventory nor managing any logistics. The search giant is aware of its dependence on e-commerce; Larry Page and industry analysts often identify Amazon as Google’s largest competitor.

Kylie Jenner’s Cosmetics Empire

Forbes recently published this widely circulated article about how Kylie Jenner built a $900M e-commerce cosmetics empire, all while outsourcing every aspect of her business — except marketing (emphasis mine):

Her near-billion-dollar empire consists of just seven full-time and five part-time employees. Manufacturing and packaging? Outsourced to Seed Beauty, a private-label producer in nearby Oxnard, California. Sales and fulfillment? Outsourced to the online outlet Shopify. Finance and PR? Her shrewd mother, Kris, handles the actual business stuff, in exchange for the 10% management cut she takes from all her children. As ultralight startups go, Jenner’s operation is essentially air. And because of those minuscule overhead and marketing costs, the profits are outsize and go right into Jenner’s pocket.

Basically, all Jenner does to make all that money is leverage her social media following.

Which of all these companies do you think earns the fattest profits? Which do you think is simplest to operate? My bet is on Kylie Jenner’s business, for both.

Apple’s $9B Search Engine Business

Goldman Sachs analyst Rod Hall reckons Google will pay $9B to Apple this year to remain iOS’ default search engine — an amount that could go up to $12B next year (source). By comparison, Microsoft’s search engine Bing generated $7B in revenue in 2017. So Apple’s “search engine business” is 28% larger than Microsoft’s — all while, you know, having no actual search engine.

Flo Crivello Newsletter

Join the newsletter to receive the latest updates in your inbox.