Mind the Moat, a 7 Powers Review

The Lindy Effect has become my top heuristic to decide what to read next. This phenomenon describes how some things tend to live longer, the longer they’ve lived — to speak plainly, if something has stood the test of time it must be important. When you’re tempted to read a book published only 2 years ago, chances are you’re just sitting downstream of the author’s self-promotion efforts. Not that there’s anything wrong with self-promotion, but it doesn’t correlate well to the quality of the book.

But one must know when to override their favorite heuristics, which is what I did with 7 Powers. Written by Hamilton Helmer and published in 2016, the book came to my attention as a recommendation from an avid reader who I knew shared my preference for tried-and-true publications. It became more compelling as I saw its glowing reviews from folks I respect like Peter Thiel, Patrick Collison, Reid Hastings, Daniel Ek, and Mike Moritz. But what really convinced me is that it’s about competitive strategy, and more specifically moats. Moats fascinate me, and I know my understanding of them still has important deficiencies.

Moats are those barriers that protect your business’ margins from the erosive forces of competition. It doesn’t matter how revolutionary your product is: even if it literally changed the face of human civilization, you’re going to get nothing for it if anybody can sell it too, arbitraging profits away. The whole surplus of the revolution will go to the consumer, and none to you. Charlie Munger phrases it this way:

When we were in the textile business, […] one day, the people came to Warren and said, “They’ve invented a new loom that we think will do twice as much work as our old ones.” And Warren said, “Gee, I hope this doesn’t work because if it does, I’m going to close the mill.”

[…]

He knew that the huge productivity increases that would come from a better machine introduced into the production of a commodity product would all go to the benefit of the buyers of the textiles. Nothing was going to stick to our ribs as owners.

[…]

And it isn’t that the machines weren’t better. It’s just that the savings didn’t go to you. The cost reductions came through all right. But the benefit of the cost reductions didn’t go to the guy who bought the equipment. It’s such a simple idea. It’s so basic. And yet it’s so often forgotten.

Silicon Valley tends to reduce moats to network effects. But a simple look at Fortune 500 companies will tell you that there exist some other very powerful moats out there. The success of commodities sellers like Kraft Heinz, Procter & Gamble, or the Coca Cola Company has certainly shown me there was a gap in my understanding of them.

7 Powers did help fill that gap. It’s a simple, straight to the point framework with enormous explanation power. Let’s see what those different “powers” are.

1. Economies of Scale

This one is pretty straightforward, but has become so well-known it’s almost overlooked. If you have very low marginal costs, you should benefit enormously from scaling — an advantage you should juice for all it’s got. That leads to companies trying to “get big fast,” not because of scale for its own sake, but because it can serve as a weapon and bring enormous profits.

Helmer uses the example of Netflix (him and Netflix CEO Reed Hastings seem to be best friends or something). One pivotal strategic moment for Netflix was their investments in originals. Before that, they had to negotiate exploitation rights on a case-by-case basis. Their holders were largely oligopolistic and hence in a position to suck all the margins out of their business. Spotify had the same problem with labels, and it’s not super fun to have to hand 70% of your revenue to a handful of suppliers, before all other expenses.

Tren Griffin calls this “wholesale transfer pricing power“, and this is Porter’s supplier power at play: once one of your suppliers gets a monopoly over one of your necessary inputs, they’ve basically turned you into their serfs. You’ll still have to sweat to find customers, raise money, and do all the other unpalatable things that come with operating a business. They’ll get to keep the best part, which is the money. That’s one big reason why restaurants aren’t profitable: they’re in a commodity business, and their rent is a fixed cost that they have to pay every month no matter what. This is also why the most successful restaurants tend to own their walls.

Being #1 pays, especially in those industries with very low marginal costs. Suppose you’re Netflix. You have 100M subscribers, and each original costs $100M — so, $1 per subscriber. Now, consider your competitor Hulu, with 20M subscribers. Delivering the same value as Netflix costs them $5 per sub, 5 times as much! That means that you can allow yourself to spend more on marketing; better content; superior user experiences; more experienced people; and even be less efficient, and still beat them.

Economies of scale are the defining forces of the software industry. Marc Andreessen, paraphrasing Jim Barksdale, puts it this way:

Here’s the magical thing about software: software is something I have, I can sell it to you, and after that, I still have it.

Building software costs the same regardless of the number of people buying it. That results in a massive scale advantage, as described by Bill Gates:

At Microsoft, our only ‘hammer’ is software…. It’s all about scale economics and market share. You can afford to spend $300 million a year improving it and still sell it at a low price.

2. Network effects

Network effects are very à la mode these days. Either because some entrepreneurs are desperate to look like the next Facebook, or because they don’t understand network effects, they’ll tend to twist the word in all sorts of ways until it seems like their business has a network effect (if you squint really hard).

The most common misconception is that network effects = virality = positive feedback loops. But none of those 3 things are the same. The simple definition is that your business has a network effect if the experience for your customers gets better as more customers join in. Virality means that each user you sign up will tend to attract more users in turn. For example, those terrible online games that used to spam your friends’ walls on Facebook didn’t have network effects — they had virality. At the end of the day, your own experience as a player was the same regardless of how many other people played.

Network effects are a very important topic in tech businesses, and expanding on them is worth its own blog post — if you’re interested in digging deeper, I recommend this a16z deck.

3. Counter-Positioning

Counter-positioning is the practice of developing your business model such that incumbents have conflicting incentives preventing them to compete effectively. For example, competing with you could hurt one of their other businesses. As Helmer admits, it’s very close to Christensen’s disruption theory, with less of an emphasis on technology and “attack from underneath.”

One example of counter-positioning is what digital cameras did to Kodak. Most people blame those failures on the incompetence or complacency of the incumbent. “Everybody knew digital photography was coming! Those dinosaurs were stupid not to get onto it first!”

Theories like Christensen’s, and Helmer’s counter-positioning, propose an opposite explanation. The incumbent is unable to respond to the disruptive threat not despite but because of its expertise and business savviness. In Kodak’s case, the disruption was two-fold: with the technology, and the business model.

From a technological perspective, digital cameras sucked, even for the mass market. The first models I saw as a kid had a resolution of 320×240 (that’s 0.07 megapixels), terrible lenses, and could hold something like 20 pictures (on a floppy disk!). It was an interesting “toy” for the super early adopters market, but not for professional photographers, Kodak’s bread-and-butter. Of course, they knew digital photography would get better. But put yourself in the shoes of Kodak’s execs during the yearly budget planning. It’s hard to take away some precious dollars and talents from your cash cow, and give them to that inferior thing which your customers are scoffing at.

The gotcha is that those technologies are often actually superior on some other dimension, and can offer features that the status quo just could not match, even with all the R&D in the world. That often comes at a cost on some other dimension — which can be fine for the market segments that don’t care about them. Christensen says these segments are “over-served” and that the disruptor is “attacking the incumbent from underneath.”

The exclusive feature of digital cameras was developing your picture right after you took it and, most importantly, for free! Digital pictures would get sharper with time, but analog would never get free, unlimited roll. And this was a very big deal, especially for professionals.

My father used to own a publishing house with a dozen small newspapers. He lugged around _entire trash bags full of camera roll_to be developed, every week-end, spending tens of thousands of dollars a year on roll and development. When digital cameras became good enough, he immediately spent the big bucks on them. It was a shock to learn he’d spent $20k on a camera and a bunch of lenses, until he explained to me that it would actually pay for itself in just a couple of months.

Which leads me to the other kind of disruption, that of the business model. Not only were digital pictures low-quality, that “free roll” also made it a super lousy business for Kodak. They made most of their profits selling high-margin camera roll. That gave that division a lot of political influence inside the company — and Kodak got successful to begin with by cutting unprofitable lines of business, to instead focus its limited resources on cash cows.

That’s why it’s often said that Christensenian (which is totally a word) disruption is not technological, as much as a disruption in the value chain. Technology can change as much as it’d like, as long as your customers remain the same. Your company grew around satisfying these customers, so if a better way to serve them emerges, chances are your organization will be able to go after it.

But some paradigm shifts are different. At first, the new tech is completely uninteresting to your existing customers, and replacing your existing product with it might reduce your margins and result in a net negative. But, on the very long term, it grows in performance and satisfies more and more of your buyers, and the larger total addressable market often more than makes up for the lower margins. Those are the shifts that can bite you, if your natural answer is to stick to your guns and “flee upmarket.”

4. Switching Costs

Stickiness of your product can protect you from the forces of competition if it locks your customers in. You can milk that moat and even deepen it by up-selling extra features, integrations, consulting, overpriced training, etc…

Helmer uses the example of SAP which, over time, can build deep roots inside your organization. Switching to another solution can be a months-long effort costing several millions of dollars, and much more in missed profits if done wrong.

Vendor lock-in is a big reason why enterprise software is so terrible and overpriced, other reasons including:

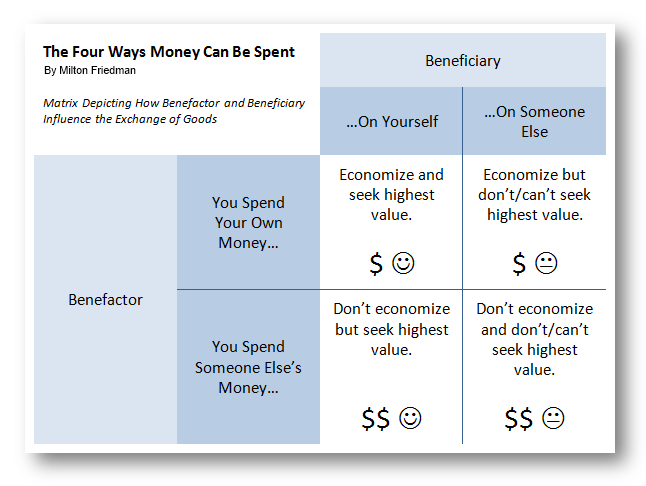

- The person who buys the software is not the same as the one who pays for it, and is not the same as the one who uses it. Per Milton Friedman’s classic matrix of “whose money’s being spent” / “who’s it being spent on,” that’s a sure way to buy crap for a lot of money. Sometimes, on the contrary, the software’s purchaser is over-incentivized on the measurable costs savings, at the expense of the immeasurable product quality.

-

The software is optimized for must-have factors like compliance, complicated workflows, rule engines, permission management, etc… and UX takes a backseat to them.

-

Companies often lack processes to re-evaluate their software purchasing decisions. I’ve seen some spend millions of dollars a year on software that hardly anybody ever used. But it was nobody’s job to reconsider the decision, and so they kept paying for it. Would you work hard on improving your product if you had a solid bedrock of such revenue?

Some other examples of customer lock-in include:

-

IBM, which still made over $1B per year with Lotus Notes in 2013. I heard the IRS’ codebase also largely runs on IBM’s PowerPC mainframes. Selling to the government can often be the guarantee of a lifelong rent for a tech company.

-

Gmail. You’ve already given your email address to all your friends and used it to sign up to hundreds of services. Gmail’s UI isn’t bad enough to justify the hassle of switching all this.

-

Photoshop, or complicated tools in general. In this case, the customer lock-in rests in the sunk cost of mastering a complex tool and learning its idiosyncrasies.

5. Brand

One of the most powerful and durable kinds of moat, as well as one of the most complicated and lengthy to build.

Brands are so powerful that they seem to be Warren Buffet’s favorite kind of moat. He’s placed famous bets on household-name brands (Heinz, Coca Cola, See’s Candies…) that build upon fundamental human preferences, and have been around for long enough to capture distribution channels (a closely related kind of moat I’ll talk about later). This keeps them growing by default, as long as they don’t screw up (Munger’s famous via negativa definition of success: not failing for long enough).

Some of the most powerful brands in the world sell commodities, like L’Oreal, Louis Vuitton, Diesel, Levi’s, Rolex, etc. This is no coincidence, and highlights one of my favorite mental models: to develop a skill, look for lifeforms that had no choice but to excel at it. The Wright brothers, designing their 1st airplane, famously spent a lot of time observing and studying birds.

(Another example is 3M. They reportedly developed compression bandages to fight ulcers, inspired by the skin of giraffes’ legs, which never develop any despite the extreme pressure on the veins of their 18-foot bodies. Likewise, if you want to learn how to differentiate and build a world-class brand, seek inspiration from the companies making a killing selling ultimate commodities.)

There is a positive feedback loop at play with brands and distribution channels. The more people know your brand, the more they expect to see it on the shelves of their favorite store, giving you more leverage over it. That allows you to get better deals with these stores — which, in turn, act as a channel for people to discover your brand, furthering its reputation, etc etc…

A lot of ink is flowing these days about the impact of the Internet on brands.

First, brands have that faculty described above to grant you leverage over distribution channels. This effect is practically nullified by the Internet’s infinite shelf-space.

Second, one of the fundamental functions of a brand is to signal quality, by getting the company to play an iterated game instead of a single move game. In game theory, this can be an effective way to get out of Pareto suboptimal equilibria. For example, turning the famous Prisoner’s Dilemma into an iterated game changes the optimal, rational strategy from (Defect, Defect) to (Cooperate, Cooperate).

Single move interactions can lead to market failures, as in the example of the Market for Lemons. You should read the Wikipedia entry if you want the whole spiel, but the gist is that there is going to be a race to the bottom in quality in a market with these 2 characteristics:

- Varying degrees of product quality

- Information asymmetry: the seller knows the quality of their product, but the buyer cannot inspect it.

Brands break that dynamic and make it a rational move to sell high quality items, since skimping on quality would hurt sales over the long run by damaging the seller’s reputation. By investing a lot on advertising and exposing itself to you again and again, a seller wants to signal: “we care about our reputation. We’re looking to build a long term relationship, and we’re never gonna give you up, never gonna let you down, never gonna run around, and desert you.”

The Internet demolishes this effect, by connecting a product’s prospective customers with its current ones. Who needs a brand when you’ve got ratings? I don’t need you to spend millions of dollars on ad campaigns. I can just ask all your current customers over there exactly how satisfied they are with your product, and how it’s holding up over time. This is a much cheaper and more direct way to break the information asymmetry.

This does not mean brands will die. The recent emergence of successful brands selling commodities online, like Anker with batteries, is a sign that there is still room for them. But it means that they might be less powerful than they once were. I suspect that the era of monster brands might have been a short parenthesis in the history of markets, closed by Amazon and other aggregators.

Another reason why brands might always be a thing is that the Internet isn’t touching one of their other fundamental functions: signaling. People want to show that they have money, or that they care a lot about the environment. And there will always be companies like Tesla to cater to these needs. The only way I could see the Internet change this is the extreme scenario of complete cultural fragmentation, where people share so few references that signaling becomes impossible. But I don’t see this happening any time soon. We need cultural Schelling points, and I see no reason why we’d be unable to develop them, short of us becoming a galactic civilization.

6. Cornered Resource

A company corners a resource when it somehow gains preferential access to it. Resources can be material as well as human: some firms have gotten so good at acquiring and retaining extremely educated talent from microscopic pools that one could argue they’ve effectively cornered that market — like Google with AI PhDs.

One famous example of a cornered resource is DeBeers and diamonds. Other examples include:

- Intellectual property, like Disney’s on their characters, or Apple’s on iOS

- Regulatory capture, an especially vicious form of cornered resource

- Stronghold on distribution channels

7. Process Power

Leaving the least obvious power for the end: process power. Helmer uses the example of Toyota, which beat GM on its own turf despite incurring sizable tariffs and shipping costs. Worse, Toyota’s leadership was always extraordinarily transparent about its processes, giving interviews and even tours to American automotive executives, telling everybody about the Toyota Production System (TPS), Kanban-based just-in-time manufacturing, “Kaizen” continuous improvement, and workers allowed, nay expected to stop their part of the production line to fix the deficiencies they identified.

They even created a joint venture with GM in Fremont, California, and trained some of their workers in Japan. But they kicked their ass all the same.

Helmer’s point is that process can contribute to product quality, customer satisfaction, sales… And remain completely irreproducible. As such, it can constitute a powerful strategic asset.

A process is not just boxes and arrows on a PDF file, or a fancy list of principles in bullet points. It is deeply embedded inside the organization, permeating its culture. The bullet points are only very high level descriptions of the principles at play. These principles are developed and applied in a myriad of ways which form their own ecosystem within each company, and are not documented in any form. At Toyota, one could say that nobody, including Toyota’s own leadership, understands their process. They just know they’ve set up certain conditions, recruited certain people early on, encouraged some broad categories of behavior while discouraging others, rinsed and repeated for 10 or 20 years, and now they have this ecosystem that produces these results. One could no more reproduce it by visiting their plants and reading HBR than they could learn to play tennis by reading books about it.

The funny thing is that, from an insider’s perspective, you just do thing as usual, not noticing anything special happening. Meanwhile, on the outside, the process looks like some voodoo producing inexplicable results, with outsiders engaging in a cargo-cult replication of your ways and clumsily translating your values in their own lingo. I certainly feel that way with tech. I have no direct experience in any other sector, so I can’t speak for what we do differently than them. But I do see all those old conglomerates spending dozens of millions in consulting, to get presentations with words like “digital convergence” and “innovation economy” all over the place, and end up promoting some guy “Chief Digital Officer” or worse, “Chief Innovation Officer.”

I’d urge any entrepreneur to get familiar with the 7 powers and adopt them as one of their key mental models. You can use it like you would go down a “moats checklist,” and see if a business has the potential to sustain high margins. That works to analyze the structure of whole industries a well.

But before closing, I need to make the mandatory side notes about the interplay between culture and strategy, and the relative importance of strategy and execution.

People have been repeating Peter Drucker’s “culture eats strategy for breakfast” so much that it’s become almost trite. Strategy isn’t something one can design from the top of their ivory tower, spewing out a massive Powerpoint presentation and corporate slogans like Moses coming down from Mount Sinai. Your actual strategy is the one you end up implementing, and it’s concretized by the way you spend your money and attention. Like Gloria Steinem said: “we can tell our values by looking at our checkbook stubs.”

All this starts with culture. When there is a clash between the Tower’s strategy and the Square’s culture, the latter will almost always win. A recent example is Alphabet and Project Maven. The company’s top leadership decided they would start working with the Pentagon on a contract worth $250M/year and possibly unlocking a much larger, $10B deal to build the US army’s entire cloud infrastructure. But Google employees disagreed, and ended up having the upper hand. Google dropped the contract.

It’s not like culture and strategy were these two separate things, one coming from the bottom, the other from the top. Instead, they are deeply interwoven. Strategy is a million small decisions made every day at all levels of the organization. Companies document few of those, and can’t even measure them. In this way, one can look at culture as a sort of meta-strategy: shaping your culture is the strategy that makes the strategy.

Finally, about the importance of strategy and execution. First, the line between those is not always that clear, as explained just above. But the distinction does exist. There is this dogma in Silicon Valley that “ideas are a dime a dozen, what actually matters is execution.” Sure, strategy is worth exactly zero without some muscle to back it up. But I dissent with the majority, and believe more and more that, on the margin, strategy is far more important than execution. Cemeteries are full of startups with poor strategy and brilliant execution — and the Fortune 500 full of giants building exactly the right products, though in a very crappy way.

IBM executed on the IBM PC with the discipline of navy seals, reaching market at scale with an amazingly executed product in just 12 months. But they made the mistake of leaving the OS to a tiny startup called Micro-Soft, which made a killing from the blunder, and made the other good decision not to give exclusivity to IBM. On the contrary, they built their OS such that it could run on equivalent PCs. As a result, IBM got stuck with its beautiful commodity in a low-margin business that it recently had to exit. And Microsoft built its empire on Windows, which was inferior to the competition in many regards, but benefited from strong network effects (software running on top of it, today we call them apps), high switching costs, and economies of scale.

I find that the principle also applies on the level of one’s individual career. If you want to be successful, working on the right thing is what matters most. I’ve seen brilliant engineers who cared about their craft like Japanese sushi chefs — documenting every aspect of their work, testing their feature thoroughly on several platforms, instrumenting and optimizing their code to make sure it runs smoothly and has no memory leak, etc… who got stuck for years, while other engineers with poorer technical skills worked on projects with a direct impact on the business, and earnt back-to-back promotions. Some cynics perceive this as dysfunctional politics — I think it’s a healthy replication of the way markets actually work. Deciding what to work on is the most important part of your job, whether you’re an entrepreneur, a manager, or an engineer.

Flo Crivello Newsletter

Join the newsletter to receive the latest updates in your inbox.